wiesiek.euArvest withdrawal limituk tv chat showsuk tv dating showuk tv dating showsuk tv phone sexuk tv pussyuk tv series about sexuk tv sexuk tv sex babesuk tv sex clipsuk tv sex education |

wiesiek.eu

i ready answers level g

cat fat chart meme

accuweather watseka

dimlet storage module

andys moms toys meme

Arvest Bank is one of the leading banks in the United States, known for its wide range of financial services and products. Many customers rely on Arvest Bank for their banking needs, including withdrawing cash from their accounts. However, like any other bank, Arvest Bank has certain limits on the amount of money customers can withdraw in a day. In this article, we will explore the Arvest withdrawal limit and provide some helpful information for Arvest Bank customers. What is the Arvest withdrawal limit? The Arvest Bank withdrawal limit refers to the maximum amount of cash that customers can withdraw from their accounts in a single day. This limit is set by the bank and may vary depending on the type of account and other factors. The purpose of having a withdrawal limit is to ensure the security of both the bank and its customers. By setting a limit, the bank can prevent fraud and unauthorized transactions. Understanding the Arvest withdrawal limit The withdrawal limit at Arvest Bank can vary depending on the type of account you have. For example, customers with a basic checking account may have a lower withdrawal limit compared to customers with a premium or high-net-worth account. It is important to note that the withdrawal limit applies to cash withdrawals made at a bank branch or through an ATM. Other types of transactions, such as online transfers or purchases, may have different limits. How can I find out my Arvest withdrawal limit? To find out your specific Arvest withdrawal limit, you can contact the bank directly. Arvest Banks customer service representatives will be able to provide you with the most accurate and up-to-date information regarding your accounts withdrawal limit. Factors that may affect your Arvest withdrawal limit Several factors may affect your Arvest withdrawal limit. Here are a few examples: 1. Type of account: As mentioned earlier, the type of account you have with Arvest Bank can impact your withdrawal limit. Premium or high-net-worth accounts may have higher withdrawal limits compared to basic checking accounts. 2. Account history: Your account history, including your transaction patterns and account balance, may also influence your withdrawal limit. If you have a long-standing relationship with Arvest Bank and maintain a healthy account balance, you may be eligible for a higher withdrawal limit. 3. Security concerns: In some cases, your withdrawal limit may be temporarily lowered due to security concerns. For instance, if there is suspicious activity on your account or if you have reported a lost or stolen card, the bank may reduce your withdrawal limit until the issue is resolved. How can I increase my Arvest withdrawal limit? If you need to withdraw a larger amount of cash and your current Arvest withdrawal limit is not sufficient, you can request an increase from the bank. To do this, you will need to contact Arvest Banks customer service and provide them with the necessary information. The bank may require additional documentation or verification before granting your request for a higher withdrawal limit. Its important to note that the bank has the final say in determining your withdrawal limit, and not all requests for an increase may be approved. The bank will assess various factors, including your account history and financial standing, before making a decision. Managing your Arvest withdrawal limit To effectively manage your Arvest withdrawal limit, it is important to plan your cash needs in advance. If you anticipate needing a larger amount of cash, such as for a major purchase or trip, it is advisable to contact the bank ahead of time to discuss your options. Additionally, its a good idea to have alternative payment methods available, such as a debit or credit card, in case your withdrawal limit is not sufficient. This way, you can still make payments or access funds even if you cannot withdraw the desired amount of cash. In conclusion, the Arvest withdrawal limit is a measure implemented by the bank to ensure the security of its customers and prevent unauthorized transactions. While the withdrawal limit may vary depending on factors such as the type of account and account history, customers can contact Arvest Bank to find out their specific withdrawal limit and request an increase if needed. By effectively managing their withdrawal limit and planning their cash needs in advance, Arvest Bank customers can ensure a smooth and secure banking experience. Schedule of Fees and Charges | Arvest Bank. Arvest Bank charges fees for select personal banking services arvest withdrawal limit. Review our personal financial services fee schedule for more information arvest withdrawal limit. . To avoid this fee, you need to maintain a balance of $10,000 or more, or complete at least one deposit or withdrawal per year (two years if the account is a money market or savings)

uk tv chat shows. No monthly service fee, $5 withdrawal fee for each withdrawal past limit Designed specifically for children under the age of 18, this savings account has no monthly service fee to worry aboutuk tv dating show. Theres a $50 minimum to open the account, but once its open, theres no minimum required to keep the account open.. ATM Withdrawal Limits: What You Need To Know - Forbes Advisor. Most often, ATM cash withdrawal limits range from $300 to $1,000 per day. Again, this is determined by the bank or credit union—there is no standard daily ATM withdrawal limit. Your.. Arvest Bank Rates for CDs, Mortgage, and Personal Accounts. 6.875%. 7.698% arvest withdrawal limituk tv dating shows. VA 30yr Fixed. $1,866.17. 6.875%. 7.220%. Mortgage rates and payments are based on loan term, creditworthiness, and collateraluk tv phone sex

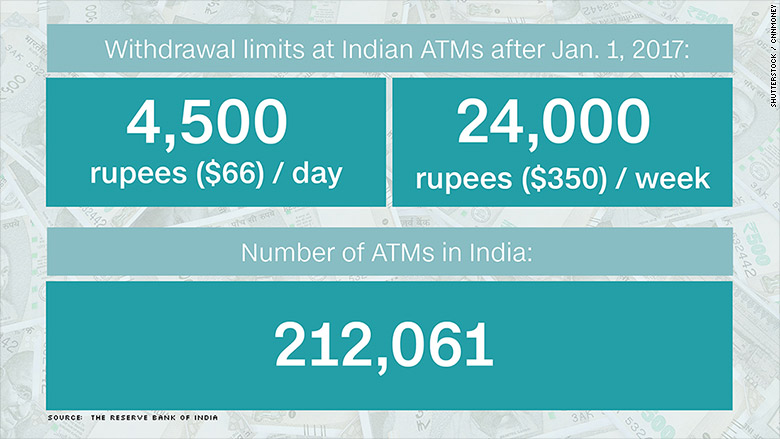

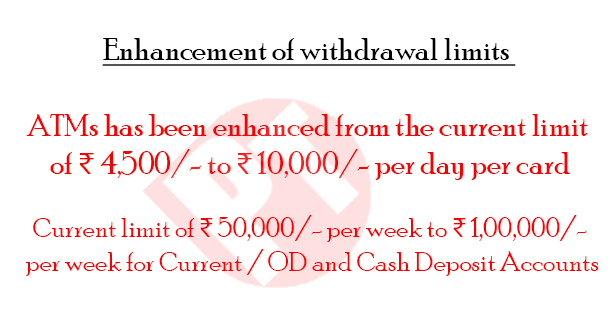

uk tv pussy. Its an understandable concern for bank customers,.uk tv series about sex. Electronic Fund Transfer Agreement & Disclosure arvest withdrawal limit. Account Transfer limit arvest withdrawal limituk tv sex. You may use your Access Code to transfer up to $10,000 between your accounts during a business day. This limit applies to eachuk tv sex babes. account. We may change this limit, in our sole discretion, at any time. Arvest Loan Payments.. Daily ATM Withdrawal Limits: How Much Is Too Much? | Bankrate. New customers may have limits as low as $500 during the first 90 days. A merican Express National Bank: American Express debuted its digital checking account in February 2022, and customers can.. Bank ATM Cash Withdrawal Limits & How To Get Around It arvest withdrawal limit. Typically, the amount is about $1,000 or less per business day. Frustrated with your bank? Check out these new top banks that people are talking about: Daily ATM Withdrawal Limits For Top Banks.. What Are Daily ATM Withdrawal Limits and Debit Purchase Limits?. Daily ATM withdrawal limits range from around $250 to $1,000 or more, in rare circumstances). Simpler tend to have lower limits than, say, a premium or elite checking account arvest withdrawal limit. Student accounts also have lower limits to help students better manage their money. Keep in mind that these limits apply to checking accounts. arvest withdrawal limit. ATM Withdrawal Limits: How Much Can You Take Out at Once?. The list below shows how the daily ATM withdrawal limits compare at some top banks and financial institutions in the country arvest withdrawal limit. However, there can always be exceptions based on your account type and your banking relationship. Ally Bank: $1,000. Bank of America: $1,000. BB&T: $500 - $1,500.. Top ways to save on overseas ATM withdrawals - The Points Guy. Choose the right debit card to save on ATM fees when traveling. There are three ways you could be hit with fees when using your debit card overseas. First, your bank could charge you a fee for using an out-of-network ATM — both at home and at ATMs abroad

uk tv sex clips. ATM withdraw limits are set by the bank and can often be increased upon requestuk tv sex education. To know your withdrawal limits, check your cardholder agreement, use online banking, or call the number on the back of the card.. Arvest Business Debit Card from Arvest Bank arvest withdrawal limit. Withdraw cash fee-free at more than 300 Arvest ATMs in Arkansas, Kansas, Oklahoma and Missouri and for a small fee at more than 400,000 Visa/Plus ATMs worldwide Request additional cards for authorized employees Purchase Security: Protects most purchases, including equipment, for 90 days against loss, theft, damage or fire arvest withdrawal limit. Banking, Investments, Mortgage Loans | Arvest Bank. Arvest Bank owns and operates 16 community banks in Arkansas, Oklahoma, Missouri and Kansas offering banking, mortgages, credit cards and investments.. |